By Tim Congdon

Within the 15 years to mid-2007 the realm economic climate loved unheard of balance (the so-called “Great Moderation”), with regular progress and coffee inflation. however the interval on the grounds that mid-2007 (“the nice Recession”) has visible the worst macroeconomic turmoil because the Thirties. A dramatic plunge in alternate, output and employment in past due 2008 and 2009 has been through an unconvincing restoration. How is the lurch from balance to instability to be defined? What are the highbrow origins of the coverage errors that resulted in the nice Recession? What theories influenced regulations within the united states and different best international locations? Which principles approximately financial coverage have proved correct? And that have been wrong?

Money in a loose Society comprises 18 provocative essays on those questions from Tim Congdon, an influential monetary adviser to the Thatcher govt within the united kingdom and one of many world’s top financial commentators. Congdon argues that educational economists and policy-makers have betrayed the highbrow legacy of either Keynes and Friedman.

These nice economists believed – if in a bit other ways – within the desire for regular progress within the volume of cash. yet Keynes has been misunderstood as advocating gigantic rises in public spending and big price range deficits because the basically method to defeat recession. That has led below President Obama to an unsustainable explosion in American public debt. in the meantime the Fed has overlooked severe volatility within the fee of cash development, opposite to the relevant message of Friedman’s analytical paintings. In his 1923 Tract on financial Reform Keynes stated, “The Individualistic Capitalism of at the present time, accurately since it entrusts saving to the person investor and construction to the person corporation, presumes a sturdy measuring-rod of worth, and can't be efficient--perhaps can't survive--without one.” In cash in a unfastened Society Congdon demands a go back to reliable cash development and sound public funds, and argues that those stay the simplest solutions to the issues dealing with smooth capitalism.

Read or Download Money in a Free Society: Keynes, Friedman, and the New Crisis in Capitalism PDF

Similar capitalism books

A User's Guide to Capitalism and Schizophrenia: Deviations from Deleuze and Guattari

A User's consultant to Capitalism and Schizophrenia is a playful and emphatically sensible elaboration of the main collaborative paintings of the French philosophers Gilles Deleuze and Felix Guattari. while learn besides its rigorous textual notes, the e-book additionally turns into the richest scholarly remedy of Deleuze's complete philosophical oeuvre to be had in any language.

Reification: or the Anxiety of Late Capitalism

Of the entire recommendations that have emerged to explain the results of capitalism at the human global, none is extra image or simply grasped than “reification”—the strategy wherein women and men are become gadgets, issues. bobbing up out of Marx’s account of commodity fetishism, the concept that of reification deals an unrivalled software with which to provide an explanation for the genuine results of the ability of capital on realization itself.

Psychology and Capitalism: The Manipulation of Mind

Psychology and Capitalism is a severe and available account of the ideological and fabric function of psychology in assisting capitalist firm and conserving members completely chargeable for their destiny during the merchandising of individualism.

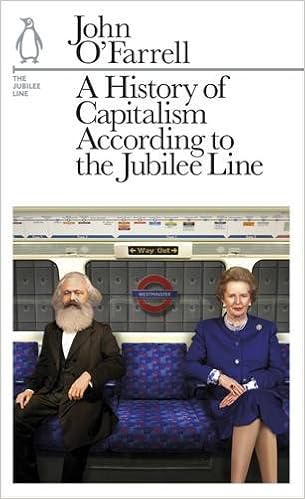

A History of Capitalism According to the Jubilee Line (Penguin Underground Lines)

'Sometimes you listen humans say "Oh I had a nightmare trip at the tube" and also you needless to say their shuttle domestic at the London Underground used to be extra disagreeable than traditional. We don't take the be aware 'nightmare' to intend that during the center of a packed carriage they actually realised that they have been donning their pyjamas after which felt their tooth crumbling as their early life maths instructor stood prior to them pointing and giggling, purely it wasn't precisely the Tube since it used to be additionally the kitchen.

- Collected Works, Volume 31: Marx 1861-63

- Dead Man Working

- 24/7: Late Capitalism and the Ends of Sleep

Extra resources for Money in a Free Society: Keynes, Friedman, and the New Crisis in Capitalism

Sample text

Churchill were based on newspaper articles. Neither pretended to be serious academic tomes. Keynes’s journalistic activity was frantic at this stage of his career and seems to have been motivated by the desire to have a big income. ) However, the two short books identified the vital monetary question of the twentieth century. If governments could no longer rely on the gold standard, how should the task of monetary management be performed? 8 6 to the pound, would it really have been advisable to make interest rates depend on the fluctuating moods of the foreign-exchange markets and the accidents of gold-mining technology?

Keynes was not concerned in his investigation of unemployment with the relationship between capital inputs and output. The vital relationships for him were those between employment, output, and demand. 7 This was a very useful assumption. Keynes could proceed to the determination of output and employment without needing a prior theory of the determination of the money wage and E s s ay 1 without troubling himself too much over microeconomic details. It might seem to follow that Keynes considered money wages to be given exogenously, perhaps as a result of bargaining.

The General Theory is the theory of the closed economy. If we want to read what Keynes said on the theory of international money . . ”4 True enough, The General Theory makes countless references to money and interest rates. But – unlike the Treatise – it does not distinguish clearly between the central bank and the commercial banks, and between legal-tender monetary-base assets (always worth their nominal value, by law) and the deposits issued by commercial banks (which might not be repaid in full if banks went bust).