By Richard A. Posner

Following up on his well timed and well-received e-book, A Failure of Capitalism, Richard Posner steps again to take an extended view of the ongoing difficulty of democratic capitalism because the American and global economies move slowly steadily again from the depths to which they'd fallen within the autumn of 2008 and the wintry weather of 2009.

by way of a lucid narrative of the predicament and a sequence of analytical chapters pinpointing serious problems with financial cave in and slow restoration, Posner is helping non-technical readers comprehend business-cycle and fiscal economics, and fiscal and governmental associations, practices, and transactions, whereas protecting a neutrality very unlikely for individuals professionally dedicated to at least one concept or one other. He demands clean puzzling over the company cycle that may construct at the unique rules of Keynes. significant to those rules is that of uncertainty instead of probability. danger may be quantified and measured. Uncertainty can't, and during this lies the inherent instability of a capitalist economic system.

As we emerge from the monetary earthquake, a deficit aftershock rumbles. it truly is in connection with that capability aftershock, in addition to to the government’s stumbling efforts at monetary regulatory reform, that Posner increases the query of the adequacy of our democratic associations to the industrial demanding situations heightened through the best financial obstacle because the nice melancholy. The hindrance and the government’s vigorous reaction to it have greatly elevated the nationwide debt even as that structural defects within the American political approach might make it most unlikely to pay down the debt in any way except inflation or devaluation.

Read or Download The Crisis of Capitalist Democracy PDF

Similar capitalism books

A User's Guide to Capitalism and Schizophrenia: Deviations from Deleuze and Guattari

A User's advisor to Capitalism and Schizophrenia is a playful and emphatically sensible elaboration of the main collaborative paintings of the French philosophers Gilles Deleuze and Felix Guattari. whilst learn in addition to its rigorous textual notes, the booklet additionally turns into the richest scholarly therapy of Deleuze's complete philosophical oeuvre to be had in any language.

Reification: or the Anxiety of Late Capitalism

Of the entire innovations that have emerged to explain the results of capitalism at the human global, none is extra photo or simply grasped than “reification”—the procedure wherein women and men are become items, issues. bobbing up out of Marx’s account of commodity fetishism, the concept that of reification bargains an unrivalled device with which to give an explanation for the true results of the facility of capital on attention itself.

Psychology and Capitalism: The Manipulation of Mind

Psychology and Capitalism is a serious and obtainable account of the ideological and fabric function of psychology in aiding capitalist firm and keeping members fullyyt chargeable for their destiny throughout the advertising of individualism.

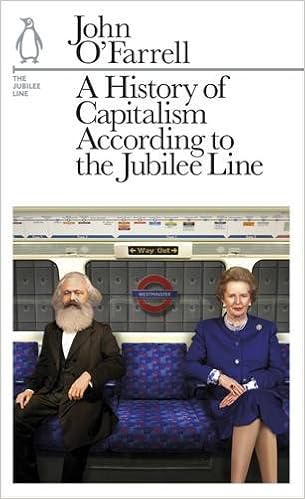

A History of Capitalism According to the Jubilee Line (Penguin Underground Lines)

'Sometimes you listen humans say "Oh I had a nightmare trip at the tube" and also you take into account that their trip domestic at the London Underground used to be extra disagreeable than ordinary. We don't take the observe 'nightmare' to intend that during the center of a packed carriage they actually realised that they have been donning their pyjamas after which felt their the teeth crumbling as their formative years maths instructor stood prior to them pointing and giggling, purely it wasn't precisely the Tube since it was once additionally the kitchen.

- Capital: A Critique of Political Economy, Volume 3 (UK Edition)

- Papers on Capitalism, Development and Planning (Collected Works of Maurice Dobb, Volume 3)

- Marx, Tocqueville, and Race in America: The 'Absolute Democracy' or 'Defiled Republic'

- Manufacturing Discontent: The Trap of Individualism in Corporate Society

- The Compassionate Revolution: Radical Politics and Buddhism

- Combined and Uneven Apocalypse: Luciferian Marxism

Extra info for The Crisis of Capitalist Democracy

Example text

Greenspan’s monetary policy thus contributed to the willingness of banks to lend against subprime mortgages. This not only increased the risk to the banks; it increased the demand for houses, and thus contributed to the housing bubble, by bringing into the market buyers who could not have obtained a mortgage at an affordable rate had it not been for the low shortterm interest rates that induced the banks to reduce their credit standards. THE CALM BEFORE THE STORM 27 The economist John Taylor has devised a rule for determining what the federal funds rate—the benchmark short-term interest rate—should be.

Greenspan’s argument that the Fed had lost control of longterm interest rates because of inflows of foreign capital and therefore could not have lanced the housing bubble even if it had wanted to cannot be squared with the fact that the bubble burst when mortgage interest rates rose, though with a lag because of 23. Alan Greenspan, “The Fed Didn’t Cause the Housing Bubble,” Wall Street Journal, Mar. 11, 2009, p. A15. 24. See, for example, Sue Kirchhoff and Barbara Hagenbaugh, “Greenspan Says ARMs Might Be Better Deal,” USA Today, Feb.

On the contrary, the government, through procurement of vaccines, medical research, and early-warning networks, engages in precautionary activity before an epidemic strikes; and the same should have been true, mutatis mutandis, regarding the financial “epidemic” that brought on the current depression. Greenspan was in the grip of the monetarist fallacy that an economic collapse can always be averted by the Fed’s reducing the federal funds rate to stimulate economic activity by increasing the amount of lendable funds that banks have.